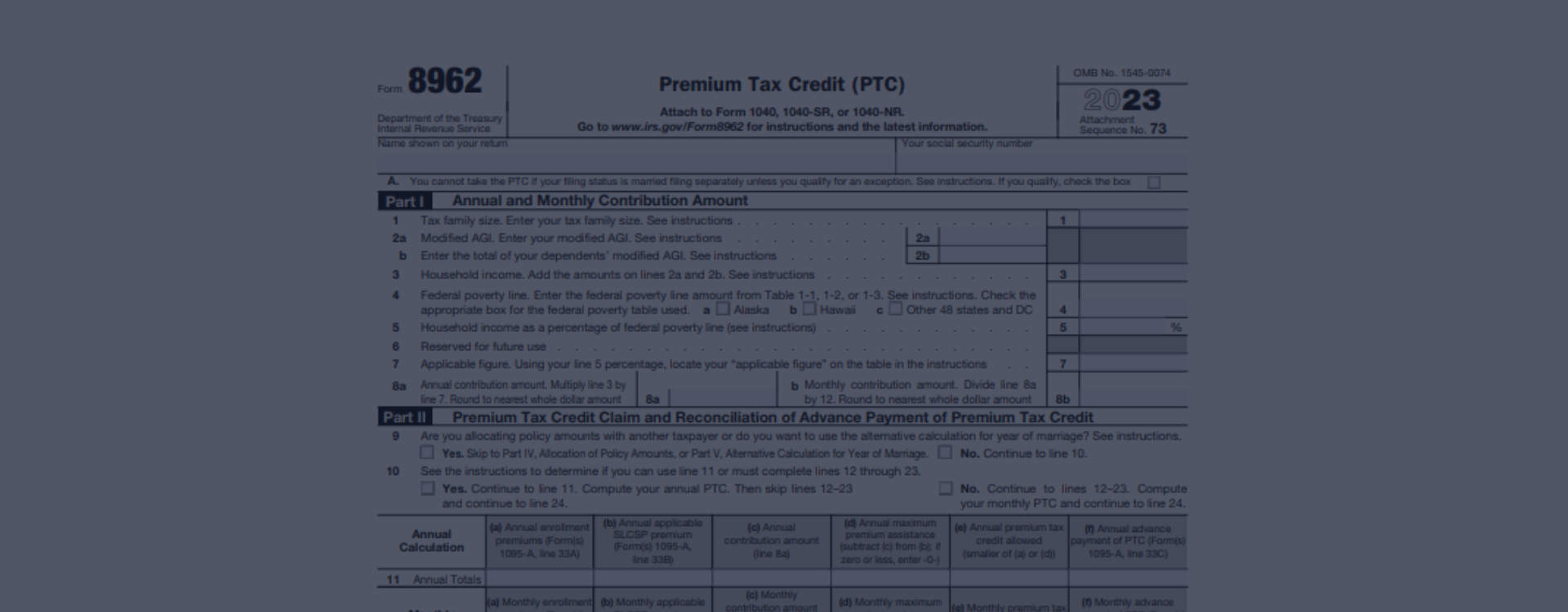

Guide for IRS Tax Form 8962 and PTC Calculations

The IRS 8962 form is an essential document for taxpayers who have received premium tax credits through the Health Insurance Marketplace. This form reconciles the credits received with the amount eligible for based on income. Accurate completion of the IRS 8962 tax form is crucial, as it ensures taxpayers can claim the correct amount of credit and avoid any potential discrepancies that could arise during the review process.

Benefits We Offer

For those seeking assistance with this form, 8962taxform.net provides a valuable resource. Our site offers a free printable tax form 8962, allowing individuals to access and prepare their documents without any cost. Moreover, the website's comprehensive federal form 8962 instructions equip taxpayers with the know-how to fill out the document accurately, using detailed explanations and illustrative examples to guide them through each step of the process. The resources available on this site ensure that even those new to tax filing can approach IRS form 8962 with confidence.

Eligibility for Premium Tax Credits

Generally, the IRS Form 8962, Premium Tax Credit (PTC), is used to calculate the exact amount of PTC individuals are entitled to and reconcile it with any advance payments of the credit (APTC) received throughout the year. Taxpayers who have purchased health insurance through the Healthcare Marketplace are required to file this form if they have received APTC or wish to claim the PTC.

Goals of the IRS 8962 Tax Form for 2023

-

![Premium Assistance]() Premium AssistanceThe 8962 form helps taxpayers reconcile the Premium Tax Credit, ensuring they receive the proper amount of financial aid for health insurance premiums based on their income.

Premium AssistanceThe 8962 form helps taxpayers reconcile the Premium Tax Credit, ensuring they receive the proper amount of financial aid for health insurance premiums based on their income. -

![Tax Accuracy]() Tax AccuracyBy using the printable IRS tax form 8962, individuals accurately report their household income and adjust any discrepancies, preventing potential issues or audits.

Tax AccuracyBy using the printable IRS tax form 8962, individuals accurately report their household income and adjust any discrepancies, preventing potential issues or audits. -

![Refund Maximization]() Refund MaximizationCorrectly filling out Form 8962 can lead to a maximized refund or reduced fiscal liability, as it clarifies the amount of tax credit the taxpayer is entitled to.

Refund MaximizationCorrectly filling out Form 8962 can lead to a maximized refund or reduced fiscal liability, as it clarifies the amount of tax credit the taxpayer is entitled to.

2023 IRS Form 8962 (PDF)

Get Form

Example of Form 8962 Use

Meet Emily, a graphic designer who opted for a health plan via the Marketplace and received APTC based on her estimated income. As her actual income varied, Emily must file the 8962 tax form for 2023 to reconcile her estimated income and tax-related credit received. Her copy will reflect any necessary adjustments to her tax liability or refund based on actual earnings.

On the other hand, James is a self-employed consultant who overestimated his annual income when applying for healthcare. He didn't receive APTCs initially thus he may be eligible for a PTC. To claim his credit, James needs to fill out the 8962 form template, providing his current income details to determine the credit he's entitled to, possibly reducing his tax bill or enhancing his refund.

Filling Out the Blank 8962 Tax Form With Ease

The IRS tax form 8962 is critical for individuals claiming the PTC since it reconciles the credit on your annual return. To ensure accuracy and avoid common errors, follow these essential steps carefully:

- Step 1: Gather the Necessary Information

Before starting, assemble all required documents. You'll need Form 1095-A, which outlines health insurance marketplace coverage, your tax return, and any records of advance payments of the PTC. - Step 2: Fill Out Basic Information

Start by entering your basic information into the tax form 8962 in PDF format. This includes your name, social security number, and the tax year. Double-check these entries for accuracy to prevent any processing delays. - Step 3: Calculate Your PTC

Proceed to the second section after two sentences and use the information from the 1095-A sample to calculate your actual PTC. It's imperative to follow the IRS tax form 8962 instructions line by line to determine the correct amounts. - Step 4: Reconcile Advance Payments

In the final part, reconcile the advance payments you have received with your calculated PTC. If you discover a discrepancy, you may owe additional tax or be entitled to a refund.

When finished, review the sample again, ensuring all the necessary information is correct and complete. After a thorough check, print tax form 8962 and attach it to your federal annual return for submission. Remember that attention to detail is key to submitting the statement without errors.

File Form 8962 on Time

When it comes to filing your taxes, ensuring that you properly complete and submit the IRS Form 8962 is crucial if you're claiming the PTC. The document is typically due by the tax filing deadline, which is generally April 15, unless an extension is granted. For those looking for resources, a federal tax form 8962 printable version is available online for ease of access and can be included with your annual return when filing.

Get FormFederal Tax Form 8962 and IRS Penalties

It's important to be aware of the consequences of missing the deadline or providing inaccurate information on your tax forms. Failing to file the copy on time can result in penalties and interest accruing on any amounts owed to the IRS. Moreover, deliberately submitting false information can lead to serious penalties, including fines and potential criminal prosecution. Avoid these risks by ensuring your IRS tax form 8962 printable is accurate and filed by the due date.

Blank Form 8962: Frequently Asked Questions

- What is the purpose of Form 8962, and who should file it?It's used to calculate the amount of premium tax credit (PTC) you are entitled to receive and to reconcile any advance payments of the credit that you may have received throughout the fiscal year. If you purchased health insurance through the Marketplace and benefited from advance payments of the premium tax credit, you must file an 8962 form for free with your annual return.

- How can I obtain a blank 8962 template to report my premium tax credits?Luckily, a free printable 8962 tax form is readily available on our website for easy downloading and printing. This allows you to accurately report your health insurance premiums and reconcile any advanced premium tax credit payments you've received during the year.

- How can I complete Form 8962 correctly?Ensuring accurate completion of your free 8962 form for 2023 involves having all necessary information at hand, including details from your health insurance Marketplace statement (1095-A). Follow the instructions step-by-step to fill out income, family size, and coverage months, which are critical for calculating your premium tax credit.

- What should I do if I need assistance while filling out Form 8962?If you require assistance, expert advice is often available through professional tax preparers or IRS resources. Our website also offers guidance and instructions to help you understand the requirements for entering information on your fillable 8962 form.

- After completing my copy, where can I print Form 8962 for filing?Once you've clicked the "Get Form" button on the top of the page, you can easily print the blank document from our website. Ensure that it is signed and included with your federal return when you are filing. Remember to review the sample thoroughly to prevent any errors that could delay the processing of your return.

More Instructions for the 8962 Tax Form

Printable 8962 Form The IRS Form 8962 is integral for taxpayers who are claiming the Premium Tax Credit (PTC). This credit is available to individuals and families who obtain their health insurance through the Health Insurance Marketplace and meet certain income criteria. The layout of the printable 8962 form for 2023...

Printable 8962 Form The IRS Form 8962 is integral for taxpayers who are claiming the Premium Tax Credit (PTC). This credit is available to individuals and families who obtain their health insurance through the Health Insurance Marketplace and meet certain income criteria. The layout of the printable 8962 form for 2023... - 20 December, 2023

- Free 8962 Form When it comes to tax time, understanding the purpose of different forms is crucial to ensure you are in compliance with IRS rules and regulations. IRS Form 8962 is used to calculate the amount of your Premium Tax Credit (PTC) and reconcile it with any advance payment of the premium tax credit (APTC)...

- 19 December, 2023

- Federal Form 8962 The Affordable Care Act (ACA), enacted in 2010, included provisions to make health insurance more affordable to Americans through the Health Insurance Marketplace. One of the key elements was the introduction of Premium Tax Credits (PTC). To reconcile these credits with actual income and ensure prop...

- 18 December, 2023

Please Note

This website (8962taxform.net) is an independent platform dedicated to providing information and resources specifically about the federal 8962 tax form, and it is not associated with the official creators, developers, or representatives of the form or its related services.