Federal Form 8962

- 18 December 2023

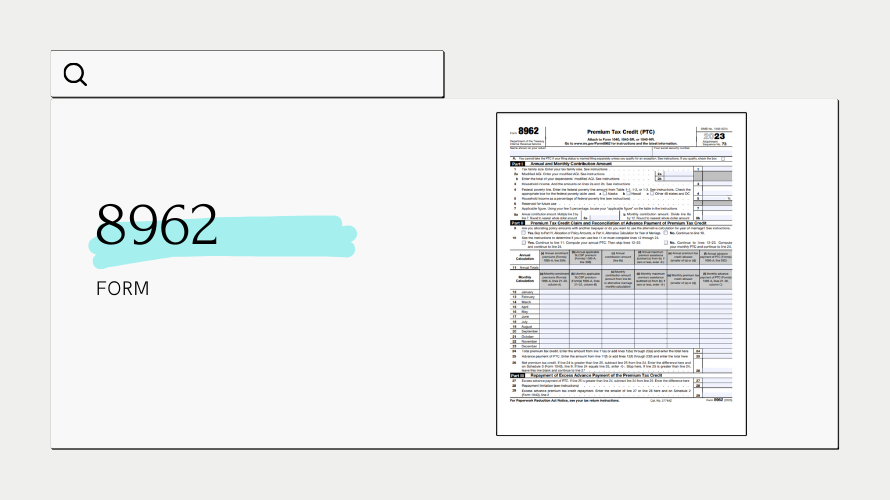

The Affordable Care Act (ACA), enacted in 2010, included provisions to make health insurance more affordable to Americans through the Health Insurance Marketplace. One of the key elements was the introduction of Premium Tax Credits (PTC). To reconcile these credits with actual income and ensure proper distribution, the IRS introduced federal tax form 8962. This statement calculates the credit amount you're entitled to and reconciles any advance payments made on your behalf during the year.

Key Changes to Federal Tax Form 8962

Over the years since its introduction, there have been changes to Form 8962 as the IRS seeks to streamline the tax filing process and adapt to legislative amendments. The most notable revisions include adjustments in the computation reflecting changes in poverty line figures and the updating of applicable percentages that affect credit amounts. It is essential to note this when you access your federal tax form 8962 with instructions for the relevant tax year, as these updates may impact your Premium Tax Credit.

Eligibility for Using IRS Form 8962

Not everyone is required or even eligible to file 2023 federal tax form 8962 (PTC). This form is specifically for individuals who enrolled in a health plan through the Health Insurance Marketplace and received the benefit of advance payments of the Premium Tax Credit. If you choose to get these credits in advance to lower your monthly insurance premium costs, it's mandatory to file Form 8962. Conversely, if you did not get coverage through the marketplace or did not receive advance credit payments, this form does not apply to you. Also, if your income is below the filing threshold and you're not required to file a tax return, you generally won't use Form 8962. Ensure that you check the latest federal form 8962 instructions for the specific eligibility criteria for the tax year you are filing.

Maximizing Benefits with the 8962 Tax Form

Understanding how to effectively use Form 8962 can potentially save you money or prevent unexpected tax liabilities. Here are several tips to ensure you are maximizing its benefits:

- Report Income Accurately

Your expected family contribution and Premium Tax Credit are based on your estimated income. It's crucial to provide an accurate forecast and update the Marketplace if your income changes during the year to avoid repayment obligations or missed credit opportunities. - Keep Records

Maintain all records of health insurance payments and Marketplace statements (Form 1095-A) to fill out your federal tax form 8962 for 2023 accurately. This documentation is essential for verifying and reconciling advance payments with actual credits. - Understand the Repayment Caps

There are repayment caps that limit how much you have to repay if you received more advanced payments than you were entitled to. Familiarize yourself with these limits, which vary based on income level, by reviewing the federal tax form 8962 printable and related instructions. - Professional Tax Help

The calculations can be complex, especially with changes from year to year. If you're unsure, it's wise to seek assistance from a tax professional or utilize tax software programs to help guide you through completing Form 8962.