Free 8962 Form

- 19 December 2023

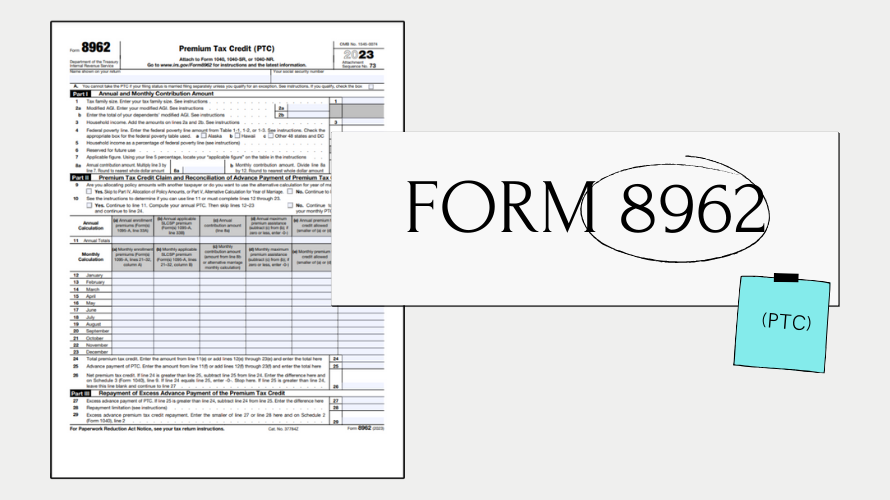

When it comes to tax time, understanding the purpose of different forms is crucial to ensure you are in compliance with IRS rules and regulations. IRS Form 8962 is used to calculate the amount of your Premium Tax Credit (PTC) and reconcile it with any advance payment of the premium tax credit (APTC) you may have received. The PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace. If you have received APTC throughout the year, the 8962 form for free helps you to report this and ensure that the amount paid was appropriate based on your actual income.

If you are looking for a free 8962 form for 2023, you can trust our site to deliver the document you require, ready to be filled out and lodged with your tax return. Having the correct forms at hand simplifies the process of staying compliant with the IRS and managing your tax responsibilities efficiently.

Eligible Form 8962 Fillers in the U.S.

- Individuals who have not enrolled in a health insurance plan through the Marketplace should not use this form.

- If you did not receive APTC and are not required to reconcile, you do not need Form 8962.

- Persons who are claimed as dependent on another person’s tax return are not eligible to use Form 8962.

- Those who could be claimed as dependents by another taxpayer but are not actually claimed on any tax return should avoid Form 8962.

Tax Form 8962 in Action: A Fictional Example

Imagine Emily, who estimated her yearly income to be $30,000 when she applied for health insurance through the Marketplace. Based on her estimate, Emily qualified for APTC, which reduced her monthly premium amount. At year's end, Emily's actual income turned out to be $35,000. Emily must now use a free printable 8962 form to reconcile the APTC she received with her higher income level. It turns out that she was overpaid in APTC because her actual income exceeded her estimate. Emily would report this discrepancy on her tax return, and she may have to pay back the excess amount or have it deducted from her refund.

IRS Tax Form 8962: Common Problems and Solutions

| Common Problem | Solution |

|---|---|

| Receiving a notice stating that Form 8962 is required, but unsure how to proceed. | Review the form's instructions carefully, provide the necessary information about your health insurance and income, and then submit it to the IRS. |

| Uncertainty about whether you need to file Form 8962. | If you received APTC or are claiming the PTC, filing this form is necessary. |

| Inaccuracies in the reported income or APTC leading to potential penalties. | Amend your tax return with the correct information using an updated IRS Form 8962 to avoid potential penalties. |

| Confusion on how to obtain Form 8962 without incurring costs. | Acquire a free printable IRS Form 8962 from our website, which allows you to download and print the form for your convenience easily. |

To get started with reconciling your APTC, use the 8962 form for free and print it; simply download it from our website. Moreover, filling out the document accurately is important to ensure proper reconciliation of your premium tax credits. Remember, should you encounter any difficulties or if you're unsure about your eligibility or how to fill out Form 8962 properly, consult with a tax professional for guidance tailored to your specific situation.